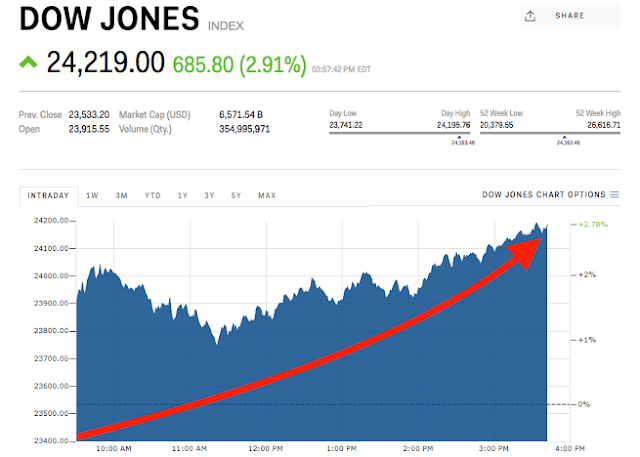

Dow Jones : The Dow Is Jumping Because Bond Yields Have Stopped Tumbling

8:38 a.m. The Dow Jones Industrial Averagelooks set for a higher open as U.S. Treasury bond yields have stopped falling.

Dow futures have risen 236 points, or 0.9%, while S&P 500 futures have gained 1%, andNasdaq Composite futures climbed 1.1%.

Why is the market going up? Some point to the rise in bond yields, with the 10-year U.S. Treasury yield sitting at 1.54%. “Rates have temporarily stopped falling, which has caused equity futures to rise nearly 1% ahead of the open,” writes Bespoke Investment Group’s Justin Walters. “It’s amazing what a pause in bond buying can do for stocks!”

Amazing.

Markets Now is a quick take on what’s happening with the Dow Jones Industrial Average and other major market indexes. Don’t forget to check out the rest of Barron’s markets coverage.

Dow rises 200 points as bond yields edge up, stocks still set for sharp weekly losses

U.S. stocks rose at the start of trade Friday, but Wall Street was still on track for weekly losses, as U.S. Treasury yields recovered from multi-year lows and investors continue to track U.S.-China trade negotiations.

How are the major benchmarks faring?

The Dow Jones Industrial Average DJIA, +0.53% rose 200 points, or 0.8%, at 25,776, while the S&P 500 index SPX, +0.82% added 22 points, or 0.8%, at 2,871. The Nasdaq Composite index COMP, +1.04% gained 77 points, or 1%, to 7,842.

Stocks seesawed between gains and losses to end mostly higher Thursday, taking back a portion of Wednesday’s selloff. The Dow on Thursday rose 99.97 points, or 0.4%, to end at 25,579.39, while the S&P 500 rose 7 points, or 0.3%, to 2,847.60. The Nasdaq Composite bucked the trend, ending at 7,766.62, a decline of 7.32 points, or 0.1%.

Through Thursday, the S&P 500 was holding a 2.4% loss for the week, while the Dow was off 2.7% and the Nasdaq was down 2.7%.

What’s driving the market?

Wall Street staged a relief rally early Friday, following a volatile week of trade dominated by concerns of rising U.S.-China trade tensions, weakening global economic growth and falling bond yields.

“Market players offloaded riskier assets like a hot potato and rushed to perceived safe havens like bonds and gold as trade tensions and global growth fears promoted risk aversion” earlier this week, said Lukman Otunuga, senior research analyst at FXTM, in a note. “Although Treasury yields are climbing away from record lows on Friday as some tranquility returns to markets, the movements in the bond markets are poised to remain on investors radars in the week ahead.”

A brief inversion Wednesday of the main measure of the yield curve, with the 10-year yield dipping below the 2-year, was blamed for contributing a stock-market rout. An overall decline in yields, tied in part to a global flight to safety amid economic worries, also added to the gloom, analysts said. On Friday, the 10-year yieldTMUBMUSD10Y, +0.88% was up 2.6 basis points at 1.558%. Yields and debt prices move in opposite directions.

Some analysts also tied support for stocks to hope for more stimulus from central banks. China’s state planner said it would introduce a plan to support disposable income this year and in 2020 in an effort to boost consumption, Reuters reported. Fitch rating agency noted that more than a third of central banks have loosened monetary policy in the past six months.

President Donald Trump on Thursday said he expected the U.S.-China trade dispute to be short and that September talks were still scheduled to go ahead despite rising tensions. China on Thursday said it was prepared to unspecified steps in response to Trump’s decision earlier this month to impose additional tariffs on imports of Chinese goods beginning Sept. 1.

On the economic data front, U.S. housing starts fell 4% to an annual rate of 1.19 million, the Commerce Department said Friday. Building permits, however, rose 8.4% to an annual rate 1.34 million, surpassing the consensus estimate of 1.29 million starts, according to a MarketWatch poll of economists.

“While the headline number is showing consistent weakness, when you dig into it, we’ve got a mixed read,” wrote Mike Loewengart vice president of investment strategy at E-Trade, in an email. “The pop in single-family home building, which is really the largest component of the housing market, gives us a reason to be optimistic.”

An August consumer sentiment reading is due at 10 a.m.

Which stocks are in focus?

Shares of farm-equipment maker Deere & Co.DE, +4.70% were up 1.2% Friday after it topped expectations for revenues, but fell short on earnings.

Nvidia Corp. NVDA, +6.57% issued second-quarter earnings after the close Thursday that beat Wall Street expectations for the second quarter. The company surpassed estimates for both earnings and revenue for the quarter following several quarters of weak performance for the company and the chip-making industry more broadly, which had lead Nvidia’s stock to fall 22% between April and Friday’s close. Shares rose 6.4% early Friday.

Fellow semiconductor firm Applied Materials Inc. AMAT, -4.37% also reported better-than-expected fiscal third-quarter earnings and revenues late Thursday, though it provided slightly weaker-than-hoped earnings guidance for the fourth quarter. Shares were down 2%.

How are other markets trading?

Stocks closed higher in Asia Friday, with the China CSI 300 000300, +0.45% adding 0.5%, Japan’s Nikkei 225 NIK, +0.06% rising 0.1% and Hong Kong’s Hang Seng index HSI, +0.94% added 0.9%.

In Europe, stocks were on the rise, with the pan-European Stoxx Europe 600 adding 0.9%.

In commodities markets, the price of crude oilCLU19, -0.02% was up 0.1% to about $54.50 per barrel, while the price of gold GCZ19, -0.39% slid 0.5% to about $1524 per ounce. The U.S. dollar index DXY, +0.19% , meanwhile, added 0.2%.

0 Comments